When you’re investing for goals that are seven or more years in the future—goals such as saving for your retirement or a young child’s education—it’s easy to get distracted by more pressing needs or to lose motivation to keep saving. It’s helpful to think of the process as being more like a marathon than a sprint.

The most successful long-term investors are those who spend more time on planning than on choosing specific stocks, bonds, or mutual funds. They focus on defining their financial goals, considering their lifestyle demands, and determining their income needs. They stay disciplined, tune out the short-term ups and downs in the market, and generally follow these seven basic principles:

-

Have a specific goal.

Investing with no purpose other than “to make money” can lead to frustration. When you connect specific investments to specific goals, it can help you decide how much risk you can take to have a good chance of reaching each goal. It also helps keep you motivated to put money aside each month toward achieving those goals.

-

Start early.

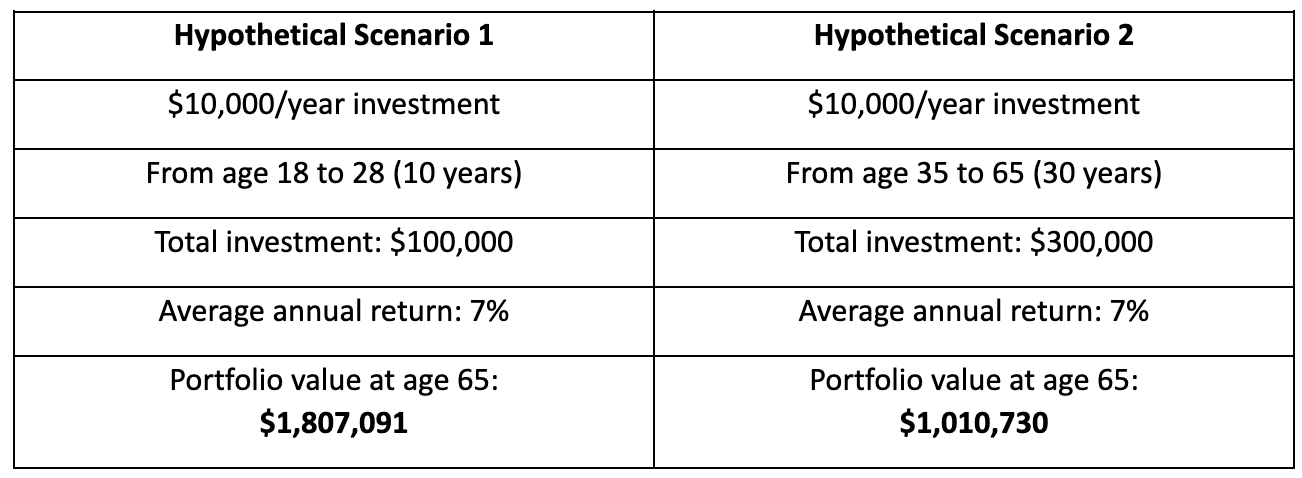

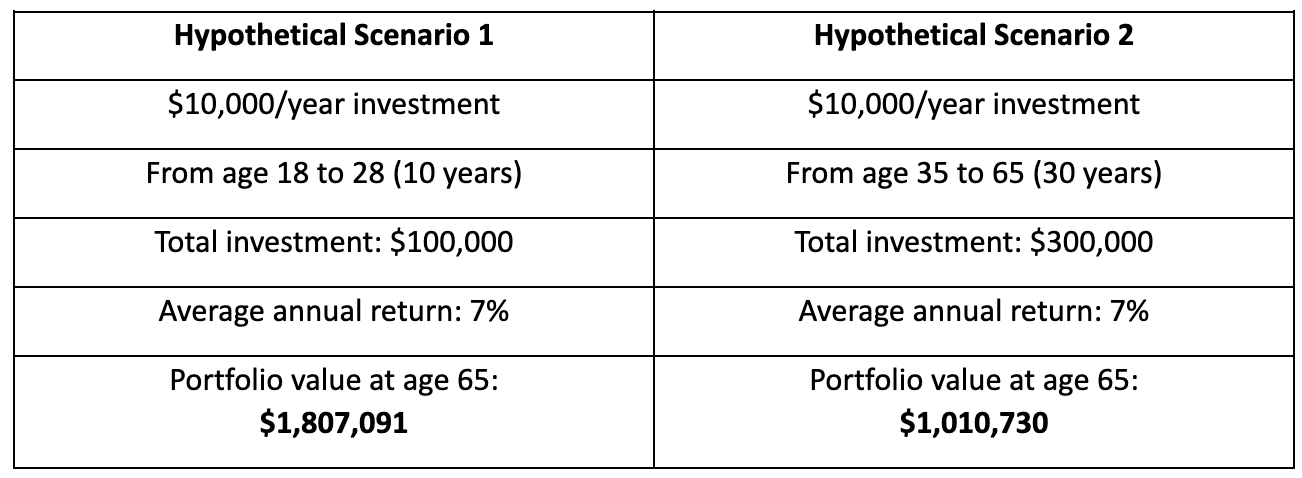

How much you save each month is important, but even more important is when you begin to save. The sooner you start, the more time your investments have to grow. With the power of compounding, you get a return on your original investment and on all the interest, dividends, and capital gains that accumulate. Over time, your money grows faster and faster, especially in retirement accounts where growth is tax-deferred or tax-free.

The following hypothetical scenarios illustrate the difference between saving $10,000 every year for 10 years starting at age 18 versus saving that same amount for 30 years starting at age 35:

-

Take full advantage of tax-deferral opportunities.

We all value the comfort of having a little extra disposable income in our paychecks, but don’t let the lure of a few more dollars today keep you from preparing for tomorrow. Like compounding, tax deferral provides an opportunity for your savings to grow faster. Many advisors suggest that you contribute at least 10% to 15% of your pre-tax income to your retirement plan. At a minimum, contribute enough to take full advantage of any matching contributions your employer may offer (it’s free money!).

-

Build an emergency fund.

As a general rule, try to set aside enough cash to cover at least six months of living expenses. This fund will help you be prepared in case of an unexpected crisis, such as a job loss, medical expenses, or an unplanned major expenditure. If you have an emergency fund, it can help you avoid needing to prematurely liquidate the assets you are using to save for long-term goals (potentially when both the economy and the stock market are slumping).

-

Take smart risks.

Although you certainly don’t want to invest in a way that’s going to make you anxious or keep you up at night, it’s important to understand that some investment risk is necessary to reach your goals. With the current rate of inflation and historically low-interest rates on savings and CDs, if you’re not investing, you’re actually falling behind. Remember that time is your greatest ally in investing. You can afford to take more investment risks when investing for your long-term goals, but you’ll want to be more conservative when investing for your short-term goals.

-

Don’t let emotion drive your investment decisions.

Remember that stocks work best over the long term, so try not to make buy or sell decisions based on daily, weekly, or even monthly gains and losses. It’s easy to get overwhelmed and give in to fear if you’re constantly monitoring financial news on television, the internet, and social media. When the markets become turbulent, make an effort to avoid information overload.

-

Periodically rebalance, but don’t tinker.

After you and your advisor have established a target asset allocation and created a well-diversified portfolio, try to stay hands-off. Aside from periodic portfolio rebalancing to bring your investments back to the target allocation, or occasional adjustments to address changing circumstances or revised goals, leave your investments to grow over time.

The stock market will rise and fall many times over the years, but the long-term trend has always been for the market to go higher. By creating a thoughtful financial plan and following these seven guidelines, you’ll be well on your way to long-term investment success.

Key Takeaways

Save and invest for specific, measurable goals.

When you set clear goals, it gives you more motivation and focus. It’s hard to save for something that is not defined.

Focus on your goals, not on short-term volatility.

With long-term goals, you can afford to take on some extra investment risk for long-term growth.

Take advantage of the power of compounding and tax deferral.

The sooner you start saving, the more time your investments have to grow and the easier it will be to reach your financial goals. Tax-deferred saving can help your investments grow even faster.